The transaction enables Speyside to further invest in Reed Minerals’ next growth phase.

The transaction enables Speyside to further invest in Reed Minerals’ next growth phase.

Angle Advisors is pleased to announce that Dalton Corporation, a portfolio company of Speyside Equity with operations in Warsaw, Indiana and Stryker, Ohio, has been sold to an undisclosed strategic buyer.

Speyside Equity Advisers announced Friday, August 25th that it has completed a continuation vehicle transaction to support future growth initiatives of portfolio company, Opta Group LLC. The transaction provides Speyside with an ability to continue its partnership with Opta while fueling the Company’s next phase of growth. The transaction was led by Elliott Investment Management L.P.

Opta is a leading supplier of performance materials and solutions in the molten metal, infrastructure, and specialty chemical industries. Speyside acquired Toronto-based Opta Minerals in 2016 and took the company private. Speyside acquired the debt of Munich-based SKW Metallurgie in 2017, and subsequently converted its position to equity and took the company private. In 2019, Speyside amalgamated SKW Metallurgie with Opta Minerals to form Opta Group LLC. Since the completion of the amalgamation, Speyside has guided the company through integration and restructuring to set up the business as a strong platform for future growth. The continuation vehicle will provide Opta with the resources to accelerate organic growth initiatives and pursue additional acquisition opportunities.

“Our operational approach at Speyside is well evidenced in this transaction,” said Eric Wiklendt, Managing Director at Speyside and Board Chair of Opta.

“Speyside looks to invest in businesses where there are opportunities for improvement and a resulting increase in value,” said Wiklendt. “With the continuation vehicle, Opta will be able to write the second chapter of value creation by executing on key product launches and acquisitions. We thank Elliott for their partnership and shared vision.”

Opta CEO, John Dietrich commented, “Speyside has been a trusted partner from the beginning. They have guided and supported our reorganization and improvement efforts at Opta. The last four years have been about building a strong operational platform from which to execute explosive growth over the next several years and achieve Opta Vision 2025. This new capitalization structure that Speyside is partnering with Elliott to bring is exactly what we need to achieve our vision.”

”“Speyside has been a trusted partner from the beginning. They have guided and supported our reorganization and improvement efforts at Opta.

John DietrichOpta CEO

Jefferies served as exclusive financial advisor through the partnership of its Private Capital Advisory and Metals & Mining teams, with McDermott Will & Emery serving as Speyside’s legal counsel. Debevoise & Plimpton acted as legal counsel for Elliott.

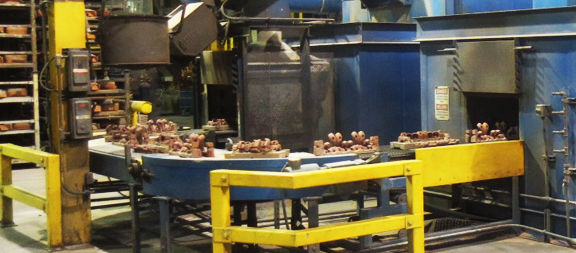

Affival Inc., part of Opta Group LLC, has found a new home. And by moving its manufacturing jobs from Plum, Pennsylvania, to nearby New Kensington, the company retained all 50 of its employees.

Affival produces cored-wire products used to alter the properties of steel. In need of new space, the company received interest from several other regions, including Indiana, Kentucky, and Mexico. Working with Pennsylvania officials, Affival completed a $6 million project to relocate its operations to a 145,000-square-foot building in the Advanced Manufacturing Park.

”This is a good investment for us. It’s an opportunity to continue to grow in the area.

Eric WiklendtSpeyside Equity Managing Director & Opta Group Board Chair

Learn how this deal came about and what it means to the economic health of Alle-Kiski Valley.