Transaction will fuel GSC’s next growth phase.

Transaction will fuel GSC’s next growth phase.

Transaction enables Speyside to fuel the company’s next growth phase.

Merger brings unmatched experience and expertise to the marketplace.

The transaction enables Speyside to further invest in Reed Minerals’ next growth phase.

Acquisition expands Opta’s performance materials and specialty chemicals platform.

Angle Advisors is pleased to announce that Dalton Corporation, a portfolio company of Speyside Equity with operations in Warsaw, Indiana and Stryker, Ohio, has been sold to an undisclosed strategic buyer.

Addition expands Opta’s premium product offerings and clean steel initiatives.

Opta Group LLC, a portfolio company of Speyside Equity Advisers (“Speyside”), is excited to announce the acquisitions of NuFlux LLC (“NuFlux”) and Nupro Corporation (“Nupro”) on Thursday, October 19, 2023.

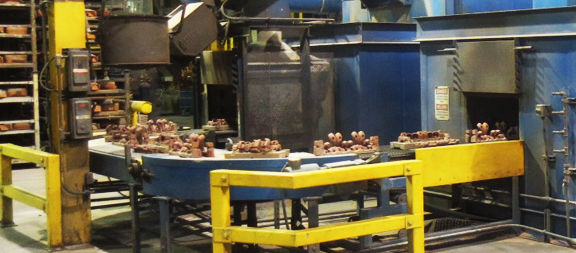

NuFlux, headquartered in Cortland, Ohio, provides engineered materials and products used primarily in steelmaking and foundry operations. Nupro is a world leader in designing innovative technology to solve problems unique to the metallurgical industry. The company has an office in Lewiston, New York.

“We like these two businesses because they share our focus on customer service and value-added molten solutions,” says John Dietrich, CEO of Opta Group. “They add product and technology innovations that strengthen our ties to Opta customers and further our goal to be a premier service provider.”

About Opta Group

Opta Group is the leading supplier of performance materials and solutions in the molten metal, infrastructure, and specialty chemical industries. The Company serves the worldwide steelmaking, metal refining, concrete and cement, and pulp and paper industries. For more information, please visit optagroupllc.com.

About Speyside Equity Advisers

Speyside is a Detroit-based private equity firm focused on investing in middle-market buyout transactions in the manufacturing and value-added distribution sectors. Targeted portfolio companies often possess balance sheet, legal, environmental, labor, or transactional complexity. Speyside Equity focuses on creative transaction structures and is comfortable investing in carve-outs of large multinational companies, industry consolidations, family-owned businesses, bankruptcies and work-outs, and other special situations. Speyside takes an operational approach to creating value in those circumstances. Speyside has completed 30 investments. For more information, please visit speysideequity.com.

”We like these two businesses because they share our focus on customer service and value-added molten solutions.

John DietrichCEO of Opta

Speyside Equity Advisers announced Friday, August 25th that it has completed a continuation vehicle transaction to support future growth initiatives of portfolio company, Opta Group LLC. The transaction provides Speyside with an ability to continue its partnership with Opta while fueling the Company’s next phase of growth. The transaction was led by Elliott Investment Management L.P.

Opta is a leading supplier of performance materials and solutions in the molten metal, infrastructure, and specialty chemical industries. Speyside acquired Toronto-based Opta Minerals in 2016 and took the company private. Speyside acquired the debt of Munich-based SKW Metallurgie in 2017, and subsequently converted its position to equity and took the company private. In 2019, Speyside amalgamated SKW Metallurgie with Opta Minerals to form Opta Group LLC. Since the completion of the amalgamation, Speyside has guided the company through integration and restructuring to set up the business as a strong platform for future growth. The continuation vehicle will provide Opta with the resources to accelerate organic growth initiatives and pursue additional acquisition opportunities.

“Our operational approach at Speyside is well evidenced in this transaction,” said Eric Wiklendt, Managing Director at Speyside and Board Chair of Opta.

“Speyside looks to invest in businesses where there are opportunities for improvement and a resulting increase in value,” said Wiklendt. “With the continuation vehicle, Opta will be able to write the second chapter of value creation by executing on key product launches and acquisitions. We thank Elliott for their partnership and shared vision.”

Opta CEO, John Dietrich commented, “Speyside has been a trusted partner from the beginning. They have guided and supported our reorganization and improvement efforts at Opta. The last four years have been about building a strong operational platform from which to execute explosive growth over the next several years and achieve Opta Vision 2025. This new capitalization structure that Speyside is partnering with Elliott to bring is exactly what we need to achieve our vision.”

”“Speyside has been a trusted partner from the beginning. They have guided and supported our reorganization and improvement efforts at Opta.

John DietrichOpta CEO

Jefferies served as exclusive financial advisor through the partnership of its Private Capital Advisory and Metals & Mining teams, with McDermott Will & Emery serving as Speyside’s legal counsel. Debevoise & Plimpton acted as legal counsel for Elliott.

Opta Group LLC, a portfolio company of Speyside Equity, announced today that it acquired Metcan Industrial Corporation and its group of manufacturing operations on November 1, 2021.

Since its incorporation nearly 30 years ago, Metcan Industrial Corp. has established itself as a recognized leader by using state-of-the-art technologies to produce and distribute high- quality, custom-blended synthetic slag for use by steelmakers.

“We like this business because Metcan has a culture very similar to ours,” says John Dietrich, CEO of Opta Group. “And, like Opta, Metcan focuses on producing highly engineered synthetic formulations. The added manufacturing capacity gives us room to pursue more business opportunities.”

”We like this business because Metcan has a culture very similar to ours. The added manufacturing capacity gives us room to pursue more business opportunities.

John DietrichCEO of Opta Group

Dean and Nancy McCann founded Metcan in 1990 to supply synthetic slag to steel manufactures. The company operates facilities in Stoney Creek, Ontario, Selkirk, Manitoba, and Adrian, Michigan.

“This opportunity aligns with Opta’s growth strategy by enhancing our capabilities and potential to reach new customers and markets,” says Nicholas Lardo of Speyside Equity.